Health Insurance License Prep iOS and Android App

Achieve Excellence in Your Health Insurance Licensing with Health Insurance License Prep!

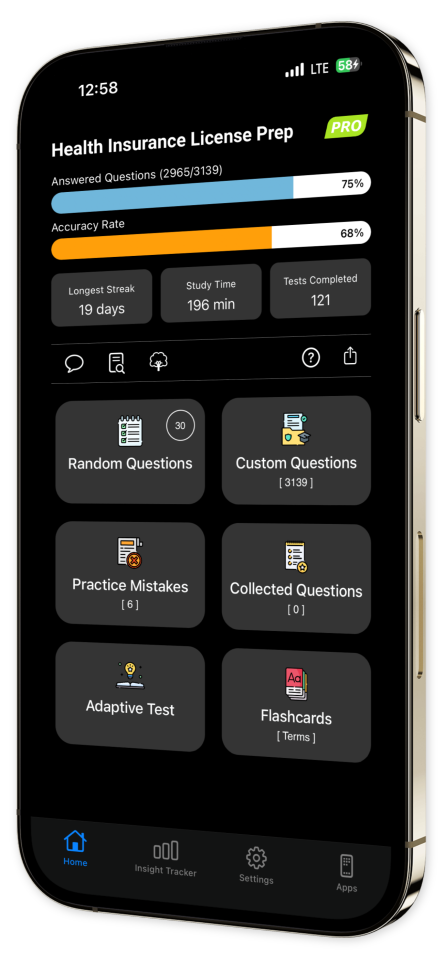

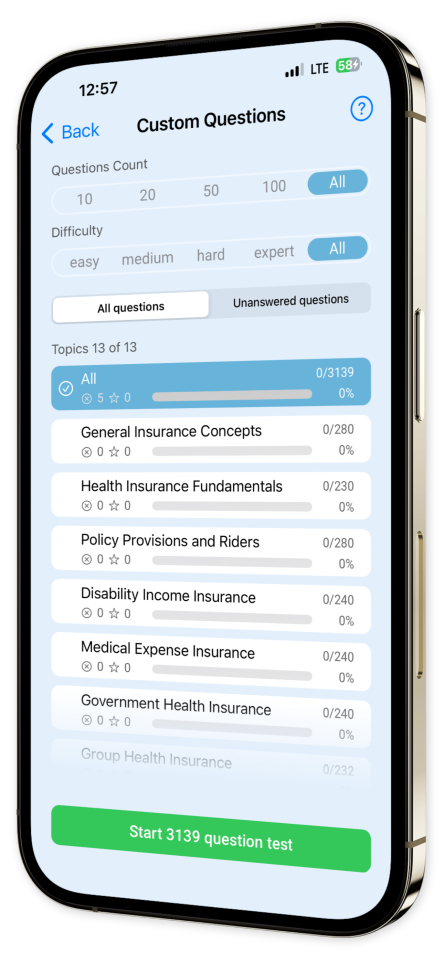

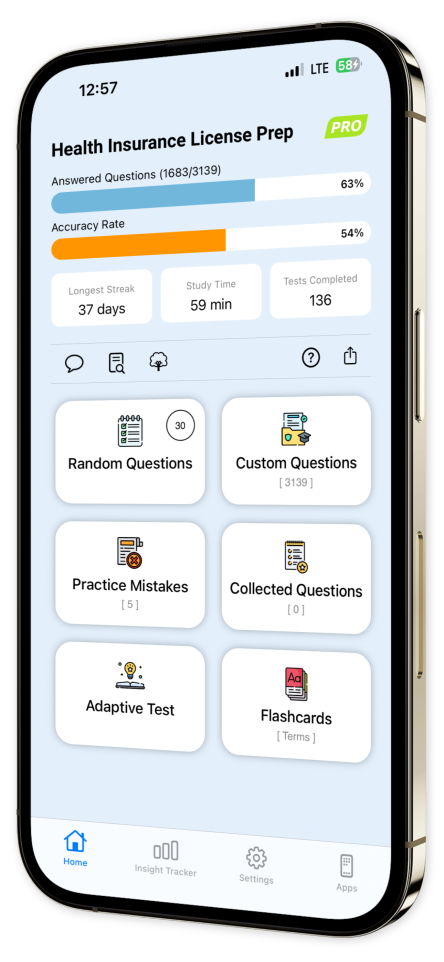

Prepare to excel in your Health Insurance Licensing exam with Health Insurance Mastery — the ultimate app for dedicated professionals striving to enhance their expertise and provide exceptional service in the insurance industry. Whether you're a newcomer or an experienced agent seeking to expand your credentials, our app is meticulously designed to help you master the critical knowledge and skills needed to succeed on your licensing exam.

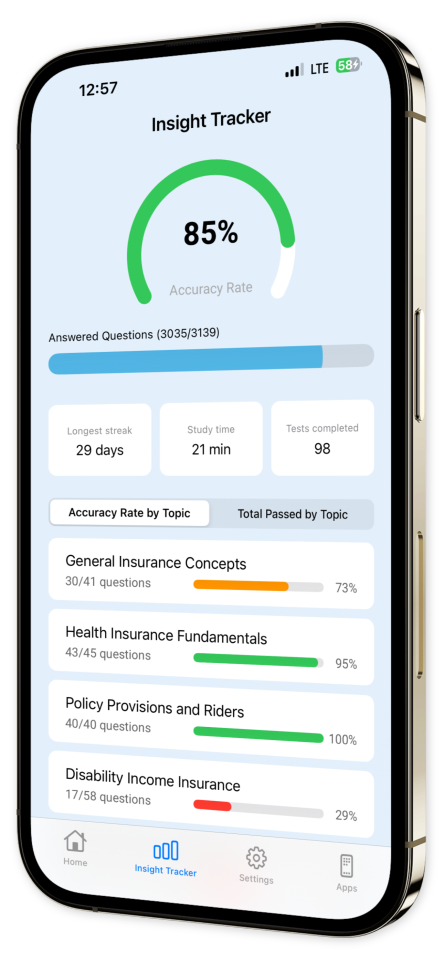

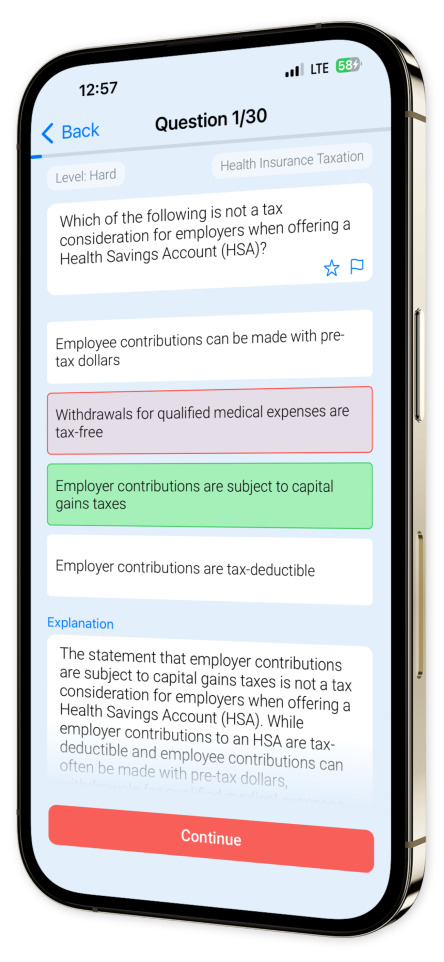

Immerse yourself in an extensive array of challenging, exam-focused questions accompanied by in-depth explanations that provide clarity on complex insurance concepts, policies, regulations, and ethical practices. With advanced analytics and personalized feedback, you can refine your understanding, identify areas for improvement, and elevate your readiness for the exam.

Join the community of insurance professionals who have achieved licensing success and advanced their careers with Health Insurance Mastery. Elevate your practice, solidify your expertise, and become a leader in the health insurance field.

Download now and take the first step toward achieving mastery in health insurance today!

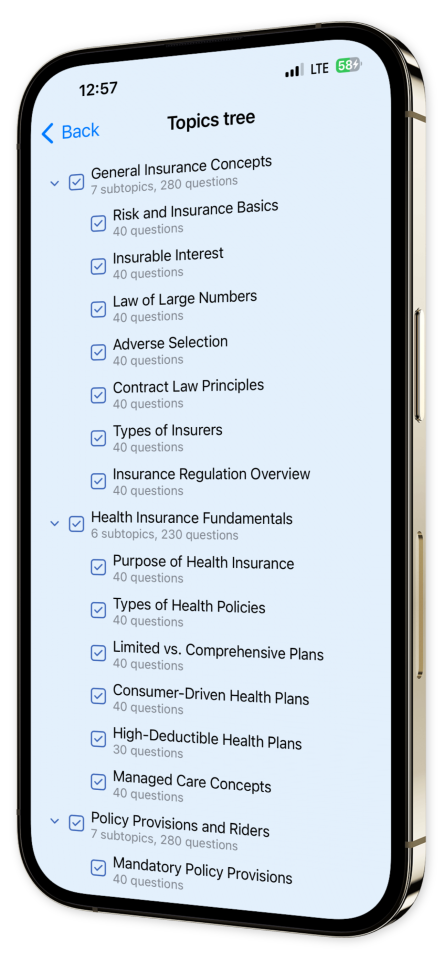

Content Overview

Explore a variety of topics covered in the app.

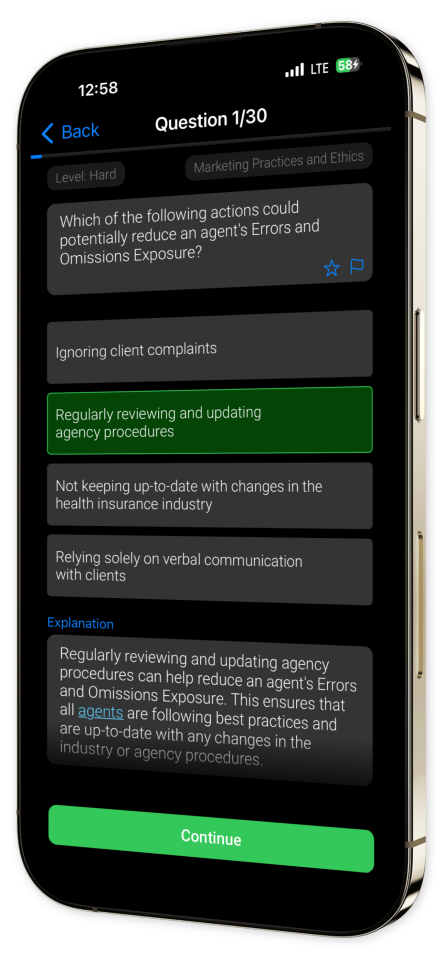

Example questions

Let's look at some sample questions

Which of the following is a potential disadvantage of a CDHP?

Lower premiumsGreater control over healthcare decisionsPotential for high out-of-pocket costsTax advantages

A potential disadvantage of a Consumer-Driven Health Plan (CDHP) is the potential for high out-of-pocket costs. Because CDHPs typically have a high deductible, individuals may have to pay a significant amount out of pocket before their insurance begins to pay.

What is not covered by Medicare Part B?

Routine physical examsRoutine foot careCosmetic surgeryAll of the above

Medicare Part B does not cover routine physical exams, routine foot care, and cosmetic surgery. These are considered non-medically necessary procedures.

What services are typically covered under the State Children's Health Insurance Program (SCHIP)?

Only emergency servicesOnly preventative servicesAll medical servicesRoutine check-ups, immunizations, hospital care, and more

SCHIP typically covers routine check-ups, immunizations, hospital care, dental care, and other services.

What is 'de-identified' information under the HIPAA Privacy Regulations?

Information that has been encrypted or otherwise rendered unreadableInformation that has been stripped of identifiers such that the remaining information cannot be used to identify an individualInformation that has been anonymized but can still be linked to an individual through a code or keyInformation that has been deleted or destroyed

Under the HIPAA Privacy Regulations, 'de-identified' information is information that has been stripped of identifiers such that the remaining information cannot be used to identify an individual.

Which level of care typically involves end-of-life services?

Hospice carePrimary careAcute careUrgent care

Hospice care is a type of care that focuses on the palliation of a chronically ill, terminally ill, or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. It is typically used for end-of-life services.

What is the main purpose of a premium receipt in health insurance?

To provide proof of paymentTo finalize the underwriting processTo provide a copy of the policy to the policyholderTo sell additional insurance products

The main purpose of a premium receipt in health insurance is to provide proof of payment. This shows that the policyholder has paid their premium and that their coverage is in effect.

Who typically buys Accidental Death & Dismemberment insurance?

People with high-risk jobsPeople with low-risk jobsPeople with no jobPeople with pre-existing health conditions

People with high-risk jobs typically buy Accidental Death & Dismemberment insurance. This is because they are more likely to get into accidents that could result in death or dismemberment.

How are long-term care insurance benefits taxed?

Benefits are fully taxableBenefits are not taxableBenefits are partially taxableTaxation depends on the amount of benefits

Long-term care insurance benefits are generally not taxable.

Who has the power to revoke an insurance license in a state?

The Federal Insurance OfficeThe National Association of Insurance CommissionersThe State Insurance CommissionerThe State Attorney General

The State Insurance Commissioner has the power to revoke an insurance license in a state.

What is the primary purpose of the Dodd-Frank Wall Street Reform and Consumer Protection Act?

To regulate the insurance industryTo protect consumers from unfair lending practicesTo reform the financial industry and protect consumersTo establish federal insurance regulations

The primary purpose of the Dodd-Frank Wall Street Reform and Consumer Protection Act is to reform the financial industry and protect consumers. It does not primarily aim to regulate the insurance industry, protect consumers from unfair lending practices, or establish federal insurance regulations.